Valuation ProfileĪs for the valuation of APAM, I am primarily looking at how they might be able to grow their AUM and how that could reflect on growing Net Income. For the fixed income portfolio of the company they primarily invest the funds in non-investment grade corporate bonds but also secured and unsecured loans.

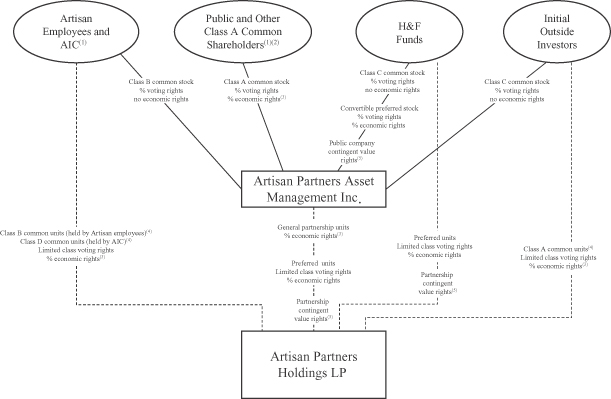

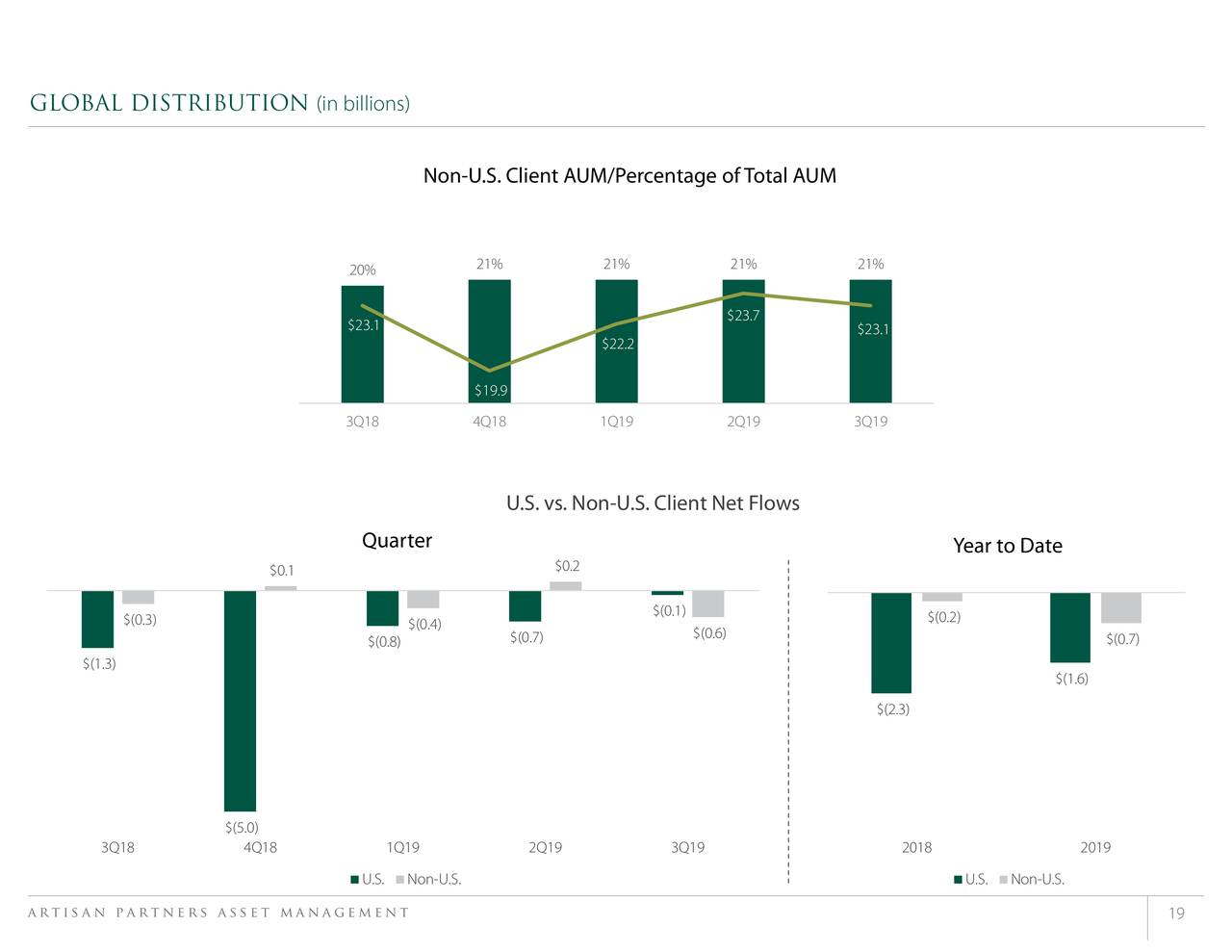

With a payout ratio of nearly 80% the priority for APAM lies with its shareholders and ensuring ample returns for them over the long term. The company prides itself on maintaining strong FCF margins and a robust balance sheet that can weather through times of lower growth and activity in the border economy. Something I think they have been very successful with so far as the ROE sits at near 72%.Ĭompany Overview (Investor Presentation May 2023) The philosophy of the business as per their own accord is to act as a “High-Value Added Investment Firm”. The broad set of offerings the company has is helping them grow quickly and now has an AUM of over $138 billion. Company StructureĪrtisan Partners Asset Management operates as an investment manager but also provides services to pension and profit-sharing plans as well as aiding with foundations and mutual funds and collective trusts. The premium which investors have to pay for APAM right now seems justified given these statistics and I will be rating APAM a buy. APAM does boast a strong balance sheet and a TTM Return on Common Equity of 71.92%, far above the sector's average of 11.1%. On top of an already near $3 per share dividend. 2022 was such a year for example, with an additional $0.72 dividend distributed during the year. The yield for APAM currently sits at 5.07% which doesn't seem unreasonably high, and with the payout ratio at just under 80%, I think there is room for a continued increase in the dividend.ĪPAM does distribute a special dividend now and again when some years generate substantial returns. They can do this as they are efficiently increasing the AUM they have, which in Q1 FY2023 grew by $10 billion. The company distributes a majority of all the cash flows generated to its shareholders. Investor Relations Inquiries: 866.632.1770 or Artisan Partners Asset Management Inc.The priority of shareholders is held high within Artisan Partners Asset Management ( NYSE: APAM). Strategies are offered through various investment vehicles to accommodate a broad range of client mandates. Artisan Partners' autonomous investment teams oversee a diverse range of investment strategies across multiple asset classes.

Since 1994, the firm has been committed to attracting experienced, disciplined investment professionals to manage client assets. Separate account AUM includes assets we manage in traditional separate accounts, as well as assets we manage in Artisan-branded collective investment trusts, and in our own private funds.Ģ AUM for certain strategies include the following amounts for which Artisan Partners provides investment models to managed account sponsors (reported on a one-month lag): Artisan Sustainable Emerging Markets $23 million.Īrtisan Partners is a global investment management firm that provides a broad range of high value-added investment strategies to sophisticated clients around the world. Total Firm Assets Under Management ("AUM")ġ Separate account AUM consists of the assets we manage in or through vehicles other than Artisan Funds or Artisan Global Funds. Separate accounts 1 accounted for $88.9 billion of total firm AUM, while Artisan Funds and Artisan Global Funds accounted for $84.0 billion. (NYSE: APAM) today reported that its assets under management ("AUM") as of totaled $172.9 billion.

MILWAUKEE, J(GLOBE NEWSWIRE) - Artisan Partners Asset Management Inc.

0 kommentar(er)

0 kommentar(er)